Driven by fast growth of China’s medical device industry, an industrial system with a complete range of categories, perfect industrial chain and solid industrial foundation has taken shape. The growth momentum had continued even in 2020, when the COVID-19 pandemic took a heavy toll on the world and the market scale had continued to expand. The pandemic has also triggered continuous technological innovations and breakthroughs.

In 2019, China's medical device market reached RMB 629 billion, doubling from RMB 308 billion in 2015. The market had maintained fast growth in 2020. Taking listed companies as an example, the total revenue of 95 China-based medical device A-share listed companies in the first three quarters reached RMB 165.814 billion, up 52.25% over the same period of previous year.

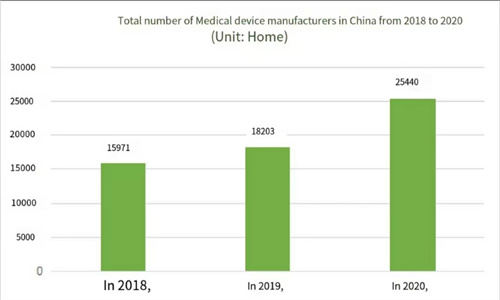

I The Number of Medical Device Manufacturers Has Increased by 39.76% Year-on-year

By the end of 2020, the number of medical device manufacturers in China had reached 25,440, a year-on-year increase of 39.76%. Among them, 15,924 companies that can produce Class I products accounted for 49.86%; 13,813 companies that can produce Class II products accounted for 43.25%; and 2,202 companies that can produce Class III products accounted for 6.89%.

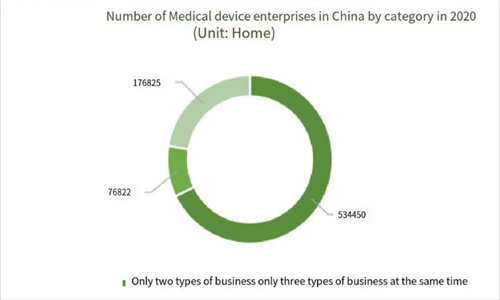

By the end of 2020, the number of medical device operators had totaled 788,097, a year-on-year increase of 29.39%. Among them, 534,450 companies operated Class II medical devices alone, 76,822 companies operated Class III medical devices alone, and 176,825 companies operated both Class II and Class III medical devices.

With respect to the distribution of medical device operators across China, Guangdong ranks first with 138,702 medical device operators, Shandong ranks second with 60,929 medical device operators, and Zhejiang ranks third with 45,177 medical device operators. The other top 10 provinces include Sichuan, Henan and Jiangsu.

The coastal provinces have a comparative advantage in medical devices operation. Inland provinces such as Sichuan, Henan and Jiangxi have become important areas for the transfer and upgrade of the medical device industry.

In terms of the number of medical device businesses across China, Shenzhen ranks first with 66,227 enterprises, Shanghai ranks second with 30,731 enterprises, and Beijing ranks third with 25,695 enterprises. The other top 10 cities include Guangzhou, Hangzhou and Nanchang.

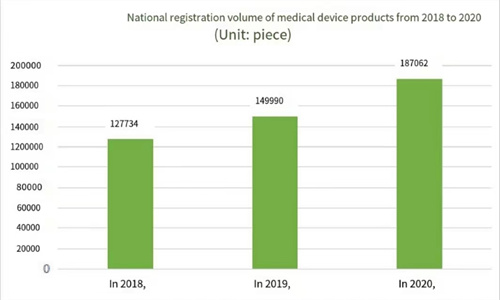

II Drastic Increase in the Number of Products

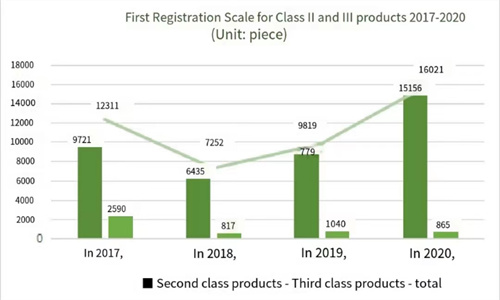

As of the end of 2020, the number of valid product registrations nationwide reached 187,062, a year-on-year increase of 24.7%. Specifically, the number of first registrations of Class II products reached 15,156, and that of Class III products reached 865.

Meanwhile, there was significant improvement in medical device innovations. In 2020, the number of patents granted to medical device enterprises reached 65,403, a year-on-year increase of 10.79%. The number of products for regulatory approval reached 86, a year-on-year increase of 34.3%.

III Acceleration of Import Substitution

For a long time, China has lagged behind some countries in terms of the development of digital photography technology, basic materials science, medical technology and other disciplines, due to which China’s medical devices market has been dominated by imported products.

With rapid development of basic science and precision equipment manufacturing in China in recent years, China’s medical device industry has made continuous technological breakthroughs and import substitution has become a general trend in the industry. More and more Chinese medical device manufacturers have stepped up R & D to further accelerate import substitution.

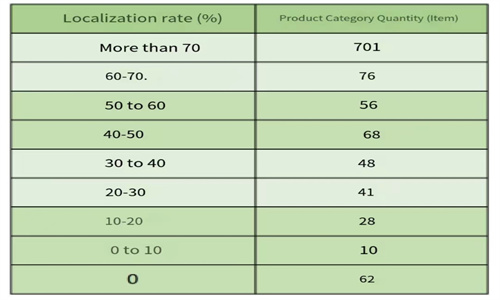

Taking Class II medical devices as an example, more than 700 categories had achieved a localization rate that exceeds 70% and only 62 categories had maintained a localization rate of 0 in 2020.

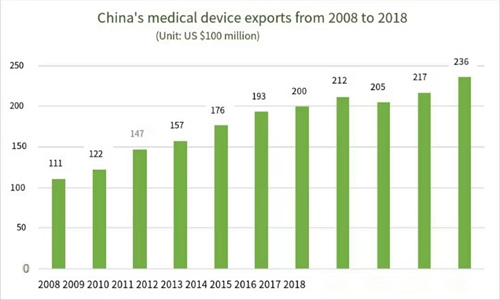

In the process of import substitution, Chinese medical device manufacturers have been actively expanding into the overseas markets and have secured a foothold in the global market. China's medical device exports had increased from US$11.1 billion in 2008 to US$23.6 billion in 2018, with a CAGR of about 8%.

IV Sound Industrial Development

China's medical devices industry is growing fast. Starting with low-end products, import substitution has penetrated into the high-end market. Though Chinese medical device manufacturers still lag behind global leaders in terms of high-end equipment R & D, they have already developed leading-edge R&D technologies in some fields. Ultrasound products, for example, have achieved import substitution, with sales of domestically produced low-end, mid-range and high-end ultrasound products accounting for 76%, 24% and 4%, respectively. Under the same technical conditions, "Made in China" products are much more cost-effective than that of imported products.

Meanwhile, Healthy China 2030, Made in China 2025, the 13th Five-Year Plan for the Development of Strategic Emerging Industries and other policies have provided guidance and support for the development of China’s medical device industry and has ushered the industry into fast growth and unveiled great prospects for it.