In recent years, China has enacted a number of policies to promote the development of the medical device industry, which has created valuable opportunities for Chinese medical device manufacturers. As an important segment of the medical device market, high-value medical consumables have developed a complete range of categories after years of rapid development. Significant progress and breakthroughs have been achieved in high-value medical consumables and biomaterials for orthopedics, vascular intervention and ophthalmology etc., and have given rise to a number of outstanding listed companies. With urbanization and population aging picking up speed in China, cardiovascular and cerebrovascular diseases, nervous system diseases, ophthalmic diseases and tumors have been on the rise, which have created great market prospects for high-value medical consumables for orthopedics, ophthalmology, vascular intervention and other fields.

NO.1 Increase in Demand Drives Rapid Market Growth

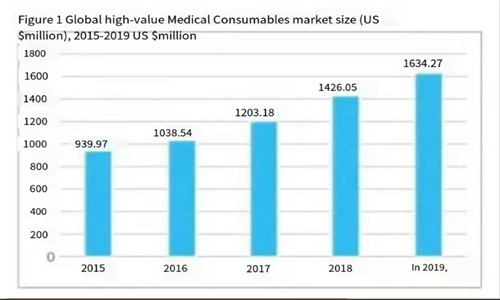

The rapid development of the healthcare industry has led to the fast growth of the global high-value medical consumables market, which reached US$163.427 billion (as shown in Figure 1) in 2019 and grew at a CAGR of 14.83% from 2015 to 2019.

Recent years have witnessed an increase in the demand for high-value medical consumables in China year by year, as the industry integrates the upstream and downstream resources, adapts to changes in user needs and enriches application scenarios. The market reached RMB 60.2 billion in 2015 and grew to RMB 129.2 billion in 2019 (as shown in Figure 2), with a CAGR of 21.04% from 2015 to 2019. In 2020, the COVID-19 pandemic triggered sharp increase in the demand for high-value medical consumables, the market size of which exceeded RMB 160 billion that year and is expected to reach RMB 335.6 billion by 2026. However, the market growth will slow down year by year due to volume-based procurement (hereinafter referred to as “VBP”), import substitution and other factors.

According to statistics about China’s high-value medical consumables market in 2019, interventional vascular consumables had the largest market size, which was RMB 46.1 billion and was followed by orthopedic implant consumables with a market size of RMB 34.5 billion. The market size of ophthalmic consumables, dental consumables, electrophysiology consumables and pacemaker consumables were RMB 9 billion, RMB 8.5 billion, RMB 8.5 billion and RMB 8.2 billion, respectively. The market size of neurosurgery consumables and non-vascular interventional consumables was RMB 4.2 billion and RMB 4.8 billion, respectively. The market size of other segments totaled RMB 5.2 billion. Among the various segments, interventional vascular consumables and orthopedic implant consumables accounted for 35.74% and 26.74%, respectively, which were higher than the market share of other segments.

Businesses in the high-value medical consumables industry are mainly divided into three categories: first, world-leading medical device manufacturers, which are known for top-notch brands, high-quality training programs, loyal customers, and abundant capital; second, small and medium-sized foreign-funded companies, which though boast good reputation and excellent product performance abroad, are not so competitive in China, for they have just entered the Chinese market and don’t know very well about it; third, the local companies.

NO.2 The Normalization of VBP Has Accelerated Import Substitution

As the VBP of medical consumables becomes a general trend, it will put an end to inflated prices of medical consumables. Taking intraocular lenses, coronary balloons and coronary stents as examples, the VBP of high-value medical consumables across China has led to evident price reduction for the covered medical consumables.

Intraocular Lenses

So far, VBP has a high coverage of intraocular lens in China. As of September 2020, China has implemented 6 VBP projects involving intraocular lenses across 22 provinces, including 2 provincial-level alliance projects, 3 provincial-level projects, and 1 municipal-level project. According to the disclosed negotiation results, the average price reduction for selected products in Anhui and Jiangsu was 20.5% and 26.89% respectively and the highest price reduction was 38%. Following the Beijing-Tianjin-Hebei "3+6" alliance negotiation, the average price reduction reached 53.72% and the highest price reduction 84.21%.

Coronary Balloons

As of September 2020, China has implemented a total of 5 VBP projects involving coronary balloons in Guizhou, Chongqing, Hainan, Hubei, Yunnan, Jiangsu, Zhejiang, Hunan and other provinces. According to the disclosed negotiation results, the price of selected products in Yunnan and Jiangsu has dropped by more than 70% and 74.37%, respectively, on average. The highest price reduction in Jiangsu and Hubei was 81.05% and 96%, respectively. The average price reduction for the pre-dilation group of the Guizhou-Chongqing-Qiong Alliance was 85.49%, and the highest price reduction 89.84%. As to the post-dilation group, the average price reduction, the highest price reduction and the overall price reduction were 85.15%, 90.35% and 85.32%, respectively.

Coronary Stents

As of September 2020, China has implemented 4 coronary stent VBP projects in Jiangsu, Shanxi and other provinces. According to the disclosed negotiation results, the average price reduction and the highest price reduction for selected products in Jiangsu was 51.01% and 66.07% respectively. The average price reduction and the highest price reduction in Shanxi was 52.98% and 69.12%, respectively. With the implementation of the coronary stent VBP policy last November, the price had further dropped sharply. The average price had dropped from RMB 13,000 to RMB 700. The highest price reduction was up to 96%, which was much higher than the price reduction in the local VBP projects.

The second round of the national high-value medical consumables VBP project involved artificial hip joints, artificial knee joints and staplers etc. According to the disclosed negotiation results, the average price reduction for orthopedic joint consumables exceeded 30% and the highest price reduction reached 81.90%. With the highest price reduction reaching 97.76%, the price of staplers had dropped to a record low. Based on the experience of the national coronary stent VBP project, the price of high-value medical consumables involved in the second round of national VBP project will hit a new low. VBP of high-value medical consumables will become a general trend in the future.

The steady progress in the implementation of the national high-value medical consumables VBP policy helps related companies occupy larger market share and accelerates import substitution in at least two respects. On the one hand, the consumables price reduction brought about by VBP will greatly reduce the profits of foreign-funded enterprises and force them to change their strategies. Earning huge profits in the past, some foreign-funded enterprises did not implement refined market management in China. Now some of them have turned to cooperate with Chinese enterprises to continue to grow their businesses in China. On the other hand, the VBP policy will lead to a sharp decline in the market share of uncovered products. As the high-end products of foreign-funded enterprises are mostly such products, they are faced with shrinking sales and revenue that cannot sustain the cost on logistics and warehousing, and are likely to be forced out.

NO.3 Focus on Key Areas and Grow by Leaps and Bounds

In recent years, technological innovations in clinical medicine, materials, biology, machining and other related fields have become more active and have driven the high-value medical consumables industry to grow by leaps and bounds. The development of technologies such as 3D printing, new materials, biological regeneration, computer aided technology and stem cells will promote quality improvement in the high-value medical consumables industry.

The development of 3D printing technology has provided more options for orthopedic implants. New materials technology is one of the cutting-edge technologies in orthopedics and vascular interventions. Use of materials that are more adaptive to the human body and are more biocompatible is essential to promoting the development of implants. At the forefront of biomedical materials, bio-based regenerative material can realize clinical tissue regeneration and wound repair and can be used to manufacture high-value medical consumables such as artificial heart valves, artificial bones and artificial corneas. In recent years, computer-aided technologies have emerged and developed rapidly. Computer-assisted navigation and positioning systems and orthopedic surgical robots, among others, have improved the accuracy and safety of surgery remarkably and have been more and more frequently used in orthopedic surgery. Stem cell technology has proved very effective in the treatment of cartilage defects, femoral head necrosis, spinal cord nerve injury, heart injury and cornea repair and embraces great potentials for further development and application.

The following segments are notable considering the growth rate, technological development status, policy support, import substitution and other factors:

Cerebrovascular and Peripheral Vascular Intervention Consumables

Cardiovascular and cerebrovascular diseases are the leading cause of death and are on the rise in China. At present, the market is dominated by foreign-funded enterprises, as China has just made a start in the development of cerebrovascular and peripheral vascular products and has not yet reached high technical level for high-end products. But a few Chinese companies have developed competitive advantages in these fields. In the future, high-quality domestic production of outstanding Chinese enterprises is expected to gain more market shares.

Blood Purifier Consumables

At present, the blood purifier market of China, especially high-value medical consumables for blood purifiers, is dominated by imported products, which account for more than 70% of the market share. As Chinese enterprises keep improving technical expertise, import substitution will continue to pick up speed. Meanwhile, with the demand far exceeding the supply in China’s dialysis market, the market has great growth potentials.

Neurosurgery is a cutting-edge discipline that poses very high requirements for the technology level and the degree of precision of high-value medical consumables used in surgery. Neurosurgery consumables have a rather short history in China, due to which Chinese products still lag far behind imported ones. At present, the various segments are still dominated by foreign brands and the import substitution rate is very low except the artificial hard brain (spinal) membrane market, which has completed import substitution. But the large market space also makes these segments one of the focuses of Chinese enterprises.

Wound Management Consumables

Wound management consumables mainly include dressings, needles and sutures. At present, the market size of absorbable materials and non-absorbable materials in China is about RMB 9.2 billion and RMB 15.2 billion respectively. Over time, absorbable materials will gradually replace non-absorbable materials, the market of which is dominated by imported products in China. As there are very few Chinese enterprises that are able to meet the domestic demand for non-absorbable materials, the overall import substitution rate has remained low.

Ophthalmic and Dental Consumables

In recent years, China has stepped up the development of domestically produced medical devices, which has increased the technology level in the relevant sectors, given rise to a number of outstanding ophthalmic and dental consumables companies, and led to a high degree of import substitution in some segments. However, denture materials, orthodontic materials and implant materials for dental and maxillofacial surgery are still dominated by foreign brands. These segments with a low degree of import substitution deserve more attention and efforts of Chinese enterprises.